ECCF is Celebrating 25 Years of Partnership in Essex County

mission

Essex County Community Foundation inspires philanthropy that strengthens the communities of Essex County by managing charitable assets, strengthening and supporting nonprofits and engaging in strategic community leadership initiatives.

impact by the numbers

invested in systems-based community leadership initiatives

individuals directly supported by systems-change efforts

organizations collaborating to address root causes of our most challenging issues

our systems approach

To address our region’s most complex social issues, ECCF employs a new kind of philanthropy, systems philanthropy.

stories of giving

Learn how a business that had once been passed down from father to son became the foundation for charitable giving that would also be passed down from one generation to the next.

stories of giving

When it comes to philanthropy, some people donate their time. Others champion their favorite causes with financial support. Then there are people like Anita Worden who jump in with both feet – because she can, and she believes she should.

stories of giving

Hearing about the devastation left behind by Hurricane Harvey, Michelle and Ben Langille’s two children got an idea. They would pick and sell the apples to raise money to help the thousands of people suffering in the aftermath.

stories of giving

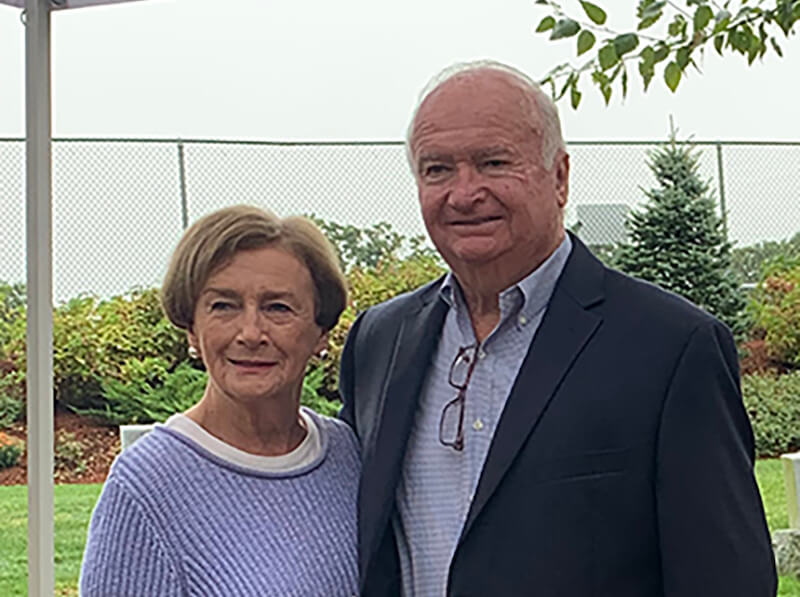

Bill and Mary Wasserman feel passionate that strong arts and culture are critical to enhancing and sustaining a vibrant lifestyle and economic opportunity in Essex County, today and for the future.

stories of giving

The Pelican Intervention Fund, founded by Newburyport residents Kim and Steven Keene and Elizabeth McCarthy, is a grassroots organization created to help men and women struggling with addiction – most notably heroin addiction.

stories of giving

Linda and Jurg Siegenthaler have had a longtime passion for the city of Lawrence. “When I left the city, it was struggling,” said Linda, who grew up in the Tower Hill neighborhood. “Now there’s a lot of effort to bring it back and I want to be a part of that.”

get involved

Join us in working to address our biggest challenges and improve the quality of life in Essex County.

the latest eccf news

During ECCF’s silver anniversary, the IFT celebrates 15 years

Annual nonprofit leadership conference a longtime cornerstone of foundation’s mission By Michelle Xiarhos Curran ECCF Communications Writer For hundreds of nonprofit leaders, the annual Institute for Trustees (IFT) has become, as Bonnie Bain from Salem Alliance for...

DeGeorge Home Improvement

Every October, employees of DeGeorge Home Improvements pack up their “skeleton crew” and set up shop in the parking lot of the Penn Brook School in Georgetown for the annual Trick- or-Trunk event hosted by the Georgetown Special Education Parents Advisory Council...

At Healing Abuse Working for Change, new digital access program transforms lives

By Michelle Xiarhos Curran ECCF Communications Writer One of the first people to sign up for a program offering free computers and internet access to clients at Healing Abuse Working for Change (HAWC) – a leading domestic violence agency serving Essex County – was a...

![NS_2017_logo_black[3]](https://www.eccf.org/wp-content/uploads/2024/02/NS_2017_logo_black3-768x164.jpg)